Biotech News: 2023 Was A Year Of Bankruptcies And Dried Up Funding For Many Biotech Companies Around The World!

Nikhil Prasad Fact checked by:Thailand Medical News Team Dec 23, 2023 1 year, 4 months, 3 days, 10 hours, 33 minutes ago

Biotech News: The year 2023 has unfolded as a challenging period for the global biotech industry, witnessing an unprecedented surge in bankruptcies among biotech companies. The struggles to secure financing, coupled with the aftermath of the COVID-19 pandemic, economic fluctuations, and rising inflation rates, have created a perfect storm for the biotech sector. This

Biotech News report delves into the intricate details of the challenges faced by biotech companies, exploring the factors contributing to their financial woes and the broader implications on the industry.

The Alarming Rise in Biotech Bankruptcies

The Alarming Rise in Biotech Bankruptcies

The financial distress within the biotech sector has manifested in a record high of 28 biotech bankruptcies in 2023, as revealed by SEC filings. This sharp increase is a stark departure from the historical trends, with only nine bankruptcies reported in 2021 and 20 in the preceding year. Experts predict that the number may continue to rise, indicating a consistent downward trend for biotech.

Contributing Factors

Several fundamental drivers underpin the surge in biotech bankruptcies, according to industry experts. One major factor is the rapidly evolving landscape of biotechnological innovation. The increasing complexity of problems, especially in fields like oncology and autoimmune diseases, necessitates substantial funding for developing cutting-edge solutions. Cody Powers, a partner at ZS Associates, notes that biotechs face more challenges today, requiring diverse programs and increased funding for success.

Interest rates also play a crucial role, as rising rates make it harder for biotech companies to raise capital. James Cassel, chairman of Cassel Salpeter & Co., emphasizes that the difficulty in raising capital due to higher interest rates has pushed more companies towards bankruptcy, leading to asset sales and liquidity challenges.

Drying Funds and Economic Malaise

The biotech industry experienced a significant increase in bankruptcies starting in 2020, with 13 reported cases. This upward trend was attributed to the economic fallout from the pandemic, causing disruptions in clinical trials and financial strain on companies. By the latter half of 2021, the financial crunch intensified, leading to a spike in layoffs and a growing number of companies running out of funds.

Ira Leiderman, managing director at Cassel Salpeter & Co., highlights the challenging market for financing, with companies struggling to secure funds, forcing some to resort to bankruptcy. The need for cash preservation and survival has become a prevailing mentality among biotech companies, evident in the numerous layoffs witnessed in 2023.

Strategies for Financial Survival

In the face of a challenging financial landscape, biotech companies are compelled to explore various strategies for survival and financial sustainability. Planning becomes paramount, with an emphasis on raising sufficient capital and preparing for potential acquisitions or mergers. Companies are urged to extend their cash runway, thinking beyond conventional 12-month plans to more extended per

iods.

Leiderman underscores the importance of planning, stating, "It's the planning; not the plan." Companies are advised to consider scenarios such as acquisitions, mergers, and efficient winding down of operations if necessary. The use of artificial intelligence in drug discovery and development is seen as a potential avenue for time and cost savings, offering a glimmer of hope for the future of biotech financing.

Biopharma Industry in 2023: A Year of Contradictions

As the year 2023 draws to a close, the biopharma industry reflects a paradoxical state. Despite advancements in certain areas, the overarching theme remains one of challenges and setbacks. The industry is projected to raise US$24 billion this year, a substantial decline from the peak years of 2020 through 2022, where annual values reached US$38.1 billion, US$53.9 billion, and US$36.9 billion, respectively.

Workforce Reductions and Market Strategies

Layoffs continue to plague the sector, with major players like Biogen and Pfizer implementing significant workforce reductions. Biogen's "Fit for Growth" cost savings program led to a 1,000-job cut, while Pfizer's restructuring aimed to eliminate 500 positions. The industry is grappling with the need to rethink market strategies and cut costs, leading to reductions in research and development investments and product pipeline culling.

Mergers and Acquisitions in a Slow Year

The M&A front, while experiencing a rebound in 2023, remains relatively slow. Pfizer's notable US$43 billion acquisition of Seagen stands out, indicating a trend toward increased investor interest in weight loss and cardiovascular diseases for 2024. However, exit activity, including initial public offerings, has been sluggish, with only 84 deals totaling US$17.9 billion projected for the year.

Regulatory Challenges and Industry Evolution

The industry has also faced regulatory challenges, particularly with the implementation of the Inflation Reduction Act’s Drug Price Negotiation Program. Initially met with resistance from Big Pharma, the industry eventually capitulated, participating in negotiations for the first 10 selected drugs. The outcome of these negotiations, to be published by September 1, 2024, will have significant implications for drug pricing.

The 2023 Biotech ‘Deaths’: A Record Year for Closures

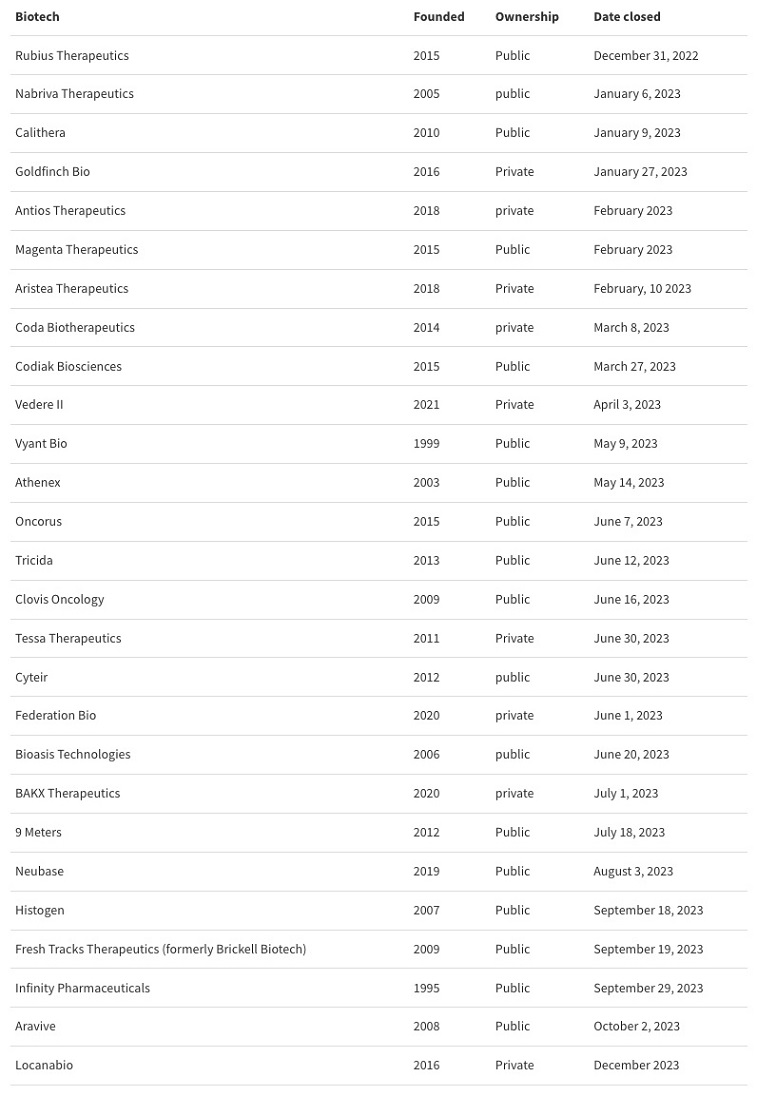

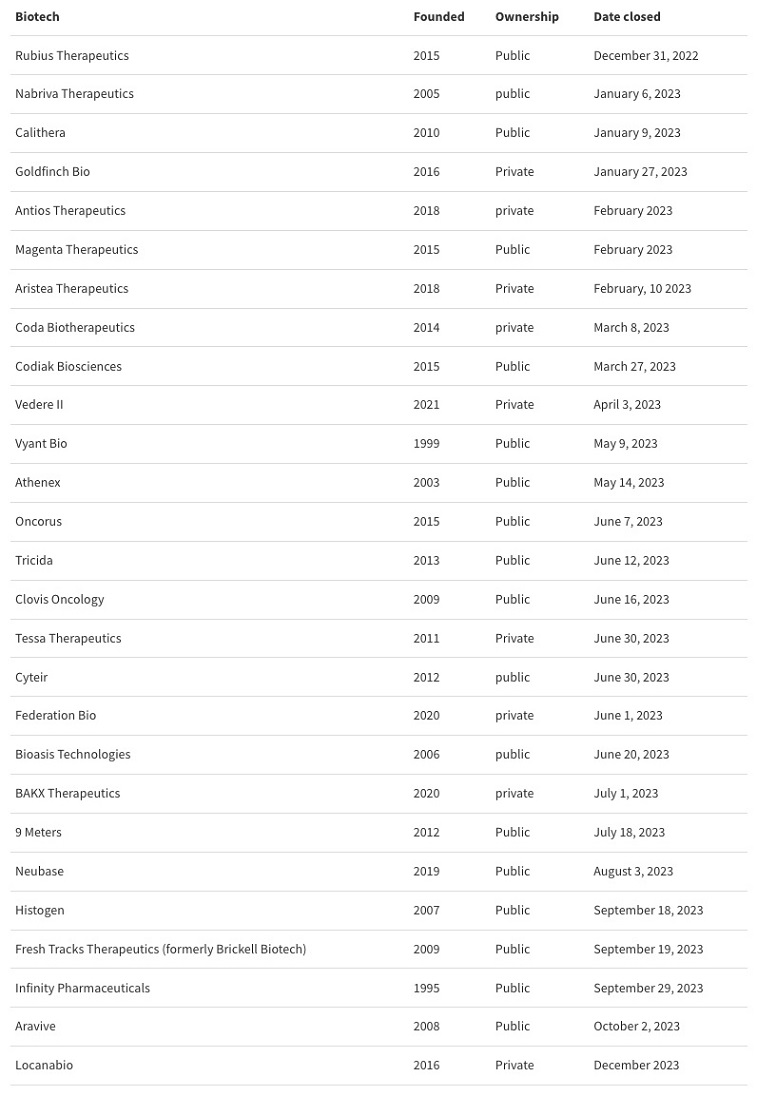

The challenges of 2023 are epitomized by the substantial number of biotechs closing their doors or filing for bankruptcy. A total of 28 biotechs have shuttered operations or disclosed plans to do so, marking a significant increase from the seven companies in the previous year. See list below:

Varied Causes and Timelines

Varied Causes and Timelines

The closures are not limited to a specific theme, spanning diverse disease areas, modalities, and company structures. Some closures, like that of Antios Therapeutics, occurred abruptly after substantial funding rounds in 2021, while others, such as Flagship's Rubius Therapeutics, unfolded gradually after strategic shifts and staff reductions.

June Dominates Closure Statistics

More than a quarter of the closures occurred in June, with notable examples like Cyteir and Bioasis. Cyteir's closure followed the failure of its lead cancer medication CYT-0851, despite observing durable responses. Bioasis faced closure due to the collapse of a merger with Medatech and the cancellation of a 2020 partnership with Chiesi.

Public Markets Reflect Frosty Conditions

Roughly two-thirds of the closed biotechs were publicly traded, indicating the challenges posed by frosty public markets. Magenta Therapeutics faced closure following a patient death in a leukemia treatment trial, while NeuBase halted development before any assets entered clinical trials.

Three Noteworthy Bankruptcies in 2023

The harsh funding environment and a lack of partnering deals have contributed to the record number of biotech bankruptcies in 2023. Examining three noteworthy cases provides insights into the challenges faced by companies during this tumultuous period:

-

Sorrento: Legal Troubles and Financial Strain

Sorrento, with a portfolio focusing on cancer, pain, autoimmune disease, and COVID-19 therapies, filed for bankruptcy in February 2023. Ongoing legal disputes with Patrick Soon-Shiong's NantCell and a court ruling demanding a significant payment contributed to Sorrento's financial distress.

-

9 Meters Biopharma: Clinical Trial Setbacks

A clinical-stage company specializing in rare digestive diseases, 9 Meters Biopharma, faced bankruptcy after setbacks in clinical trials for its GLP-1 agonist vurolenatide. The need for additional trials, coupled with the resignation of its CEO, led to the company ceasing operations.

-

Novan: Struggling Commercially

Despite having five commercial-stage products, Novan struggled financially, citing challenges in achieving profitability. Workforce reductions and a focus on getting berdazimer gel approved were not sufficient to stave off bankruptcy, leading the company to file for Chapter 11 and plan asset sales.

Outlook For 2024 Seems Promising

Industry leaders and stock market analysts however are optimistic about the biotech industry for 2024 and forecast a rebound.

https://www.marketwatch.com/story/biotech-stocks-set-for-a-rebound-in-2024-analysts-say-24df6236

Conclusion: Navigating Turbulent Waters

As the biotech industry grapples with a tumultuous 2023 marked by bankruptcies, closures, and financial strains, companies are urged to navigate these turbulent waters strategically. Planning for multiple scenarios, extending cash runways, and exploring innovative financing models become imperative for survival. The integration of artificial intelligence in drug development provides a glimmer of hope for the industry's future. As the year comes to a close, the biopharma sector faces uncertainties, leaving stakeholders cautiously optimistic about the challenges and opportunities that 2024 may bring.

For the latest

Biotech News, keep on logging to Thailand Medical News.